The D. E. Shaw Group Calls for Further Change at Verisk and Sends Letter to Board of Directors

Says Verisk Should Position Itself as a Pure Play Insurance Data Business

Verisk Can Double Earnings Per Share By 2025 With The D. E. Shaw Group's Value Creation Plan

Recommended Actions Are Necessary To Realize Significant Value Creation Opportunity

NEW YORK, March 17, 2022 /PRNewswire/ -- The D. E. Shaw Group ("D. E. Shaw") today sent a letter to the Board of Directors at Verisk Analytics, Inc. (the "Company," "Verisk Analytics" or Verisk") (Nasdaq: VRSK) calling for changes required for the Company to realize its opportunity to drive superior returns for shareholders. Funds advised by D. E. Shaw & Co., L.P. are shareholders in Verisk with a significant economic position.

The full text of the letter follows:

March 17, 2022

Board of Directors

Verisk Analytics, Inc.

545 Washington Boulevard

Jersey City, NJ 07310

Re: Further Change Required at Verisk Analytics

Dear Members of the Board:

We are writing to you on behalf of certain investment funds advised by D. E. Shaw & Co., L.P., a member of the D. E. Shaw group. The D. E. Shaw group is a global investment and technology development firm with more than $60 billion in investment and committed capital and a history of working with companies to create long-term, fundamental value. Funds advised by D. E. Shaw & Co., L.P. are shareholders of Verisk Analytics, Inc. (the "Company" or "Verisk") and currently hold a significant economic position in the Company.

We are seriously concerned about the long-term underperformance of the Company's share price and have been privately engaging with you for nearly five months in an effort to help the Company focus its business, improve its operations, and enhance its Board and governance. While we welcome the recent actions the Company has taken to implement some of the steps we have been recommending, including selling Verisk Financial Services, declassifying the Board, and separating the role of Chairman and CEO, we believe these belated changes are reactive in nature and do not go nearly far enough in reversing a longstanding pattern of underperformance. If Verisk is to reach its full potential and generate significant value for all of its shareholders, further change is necessary.

We believe that with the right set of changes, including an unequivocal commitment to positioning the Company as a standalone insurance-focused business, a commitment to organic growth acceleration and profit margin expansion within that business, and credible Board oversight, Verisk's stock price could appreciate by over 70%, which would equate to more than $20 billion of value creation for shareholders.

Verisk Has Underperformed Its Potential

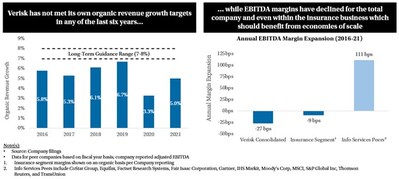

With a market-leading position and a strong competitive advantage, Verisk should be able to achieve significant organic revenue growth, margin expansion, and a premium valuation. However, Verisk has failed to deliver on its promise. Verisk's organic revenue growth has consistently disappointed relative to the Company's own expectations, missing the 7%-8% benchmark in each of the last six years, in some cases by a material amount. Over the same period, shareholders have endured surprising profit margin declines while information services peers with similar, scalable business models expanded margins by well over 100 basis points annually.

Shareholders have sustained disappointing organic revenue growth and surprising margin contraction

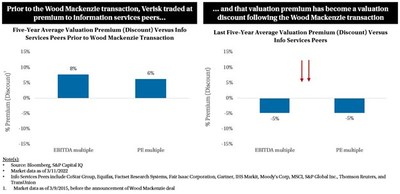

Compounding this operational underperformance, the Board permitted Verisk to allocate its capital to acquire several non-core businesses, which have served as a distraction to management, diluting the quality of Verisk's insurance assets and ultimately reducing the premium valuation historically enjoyed by the Company. For example, Verisk's Wood Mackenzie acquisition has meaningfully reduced overall company returns on capital, generating only a 4% return on invested capital during Verisk's ownership,1 well below both Verisk's stated hurdle rates and its cost of capital.

Investors have grown skeptical of how each incremental dollar of capital at Verisk will be allocated

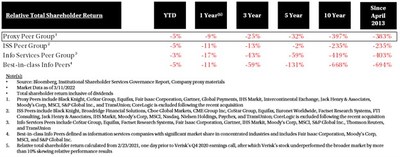

As a result of the Company's operational underperformance, misguided capital allocation, and suboptimal business configuration, shareholders have endured persistent share price underperformance for a decade. Verisk has underperformed its proxy peer set by nearly 400% during the last 10 years and its stock has underperformed in the immediate aftermath of 11 out of the last 13 quarterly reports, including after its most recent results and announcements. Verisk's stock price would need to nearly double from current levels just to match the average returns of the Company's self-selected peer set.

Information Services companies have consistently generated better financial returns than Verisk

The D. E. Shaw Group's Efforts to Drive Change at Verisk

When we approached you nearly five months ago with a letter and a detailed presentation outlining our concerns, you agreed with us that despite past operational, capital allocation, and governance missteps, Verisk had a unique opportunity to deliver significant and lasting value to shareholders. Therefore, we decided to work with you privately, collaboratively, and in good faith to reach a constructive resolution for the benefit of all Verisk shareholders.

We proposed a number of changes that we believed could help Verisk restore its position as a best-in-class data business and command the premium valuation it deserves. This set of recommendations included that Verisk commit to becoming a pure-play insurance business through separation of all non-insurance assets; renew its focus on organic revenue growth initiatives and profit margin expansion within the insurance franchise; undertake several governance changes; and appoint new, independent directors whom shareholders would trust to help oversee the change that is required.

You agreed that many of these steps were appropriate, and we committed to working with you to implement them. However, as part of our ongoing discussions, we found it strange that in a draft cooperation agreement you provided us that you insisted on a number of non-standard provisions, including that we publicly and privately support the Company on virtually all matters in addition to signing up to a multi-year "standstill". These requests are inconsistent with directors who are focused on accountability, and we view this as an attempt by the Board to insulate itself from criticism and stave off further action from us or other shareholders.

While we are pleased that Verisk has undertaken some of the reforms for which we have been advocating for months, and are hopeful that these changes will be the start of a performance and valuation improvement that shareholders deserve, we remain concerned that the Board is seeking to do the bare minimum required to preserve its position and prevent more shareholder action. As a result, the changes that we believe are the most important and have the most value creation potential have not been enacted. Rather than focus on maximizing shareholder value, the Board appears to be striving to prevent itself from being held accountable for a multi-year record of underperformance and has failed to commit to the most significant reforms we have recommended.

Further Change Is Required

We continue to believe that Verisk has an opportunity to generate substantial value for its shareholders, but the Board's reactive response to our concerns simply is not enough. The Company's inability to fully commit to important potential reforms—becoming a pure-play insurance-focused business and articulating specific cost-reduction targets for which it would be held accountable—during its recent earnings call left shareholders wondering about both portfolio composition and the profit outlook for the Company and cast doubt upon the Board's commitment to substantive change.

If the Board is serious about addressing the performance gap to peers, it must act urgently to transform Verisk into a new and improved standalone insurance data business with enhanced financial performance and credible governance and oversight. We believe that all of the common-sense reforms we have advocated for privately over the last several months put Verisk on track to getting there—and that the board should immediately take steps to implement them. We believe this set of actions, if implemented correctly with the appropriate oversight, can result in over 70% appreciation in Verisk's stock price, which would equate to more than $20 billion of value creation for shareholders.

In forming our views regarding the opportunity before Verisk, we undertook extensive research, including retaining a leading consulting firm to perform a detailed assessment of the Company's operating cost structure and organic growth opportunities; working with experienced former executives in the information services and data analytics industries; and interviewing numerous Verisk customers and others who are deeply familiar with the Company. We believe Verisk should immediately:

- Commit publicly to becoming a pure-play insurance data company: Verisk has a best-in-class insurance business that benefits from strong barriers to entry, high customer switching costs, a mission critical service offering, and limited competition. We believe that an unequivocal commitment to becoming an insurance data pure-play could help to restore Verisk's premium valuation versus its information services peers and result in a more than 25% increase in its valuation multiple.[2] In addition to the higher multiples we have seen placed on the earnings of standalone insurance data businesses,[3] a move to standalone insurance would enhance Verisk's financial profile, leading to high-single-digit organic growth and EBITDA margins well above 50%. Furthermore, a clear commitment by the Board to create a standalone insurance asset would reduce complexity for investors, streamline capital allocation, best align capital structure with the needs of the business, and substantially reduce senior management distraction. While the Company has promised to evaluate options for the remainder of its energy business, it needs to articulate a clear and unequivocal intent to streamline its portfolio by separating energy.

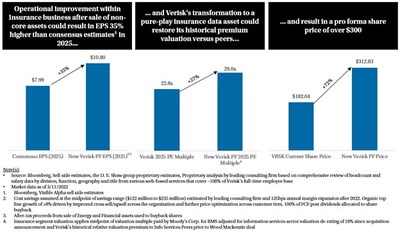

- Form an Operations Review Committee of the Board to pursue a "no stone unturned" review of Verisk's insurance business. We believe that there are significant cost optimization and organic revenue growth initiatives that could more than double Verisk's earnings per share to more than $10 per share by 2025, more than 30% higher than current analyst estimates even after accounting for potential dilution from sale of non-insurance assets. We estimate that Verisk can save approximately $120 million to $240 million within the insurance business, driving margins higher by 500 to 1,000 basis points. We have provided you with detailed recommendations for cost savings, including real estate footprint rationalization, reduction of duplicative G&A functions, better utilization of low-cost country resources, and improving management spans of control across the organization. We further believe that following the rightsizing of Verisk's current cost structure, Verisk should be able to commit to expanding margins by 100 to 150 basis points per year, thus ensuring that shareholders benefit from the natural economies of scale that exist within a data analytics business. Verisk also has the opportunity to meaningfully accelerate organic top-line growth through better leveraging of cross-sell and upsell opportunities across the organization and further optimizing pricing along customer tiers. Finally, Verisk should endeavor to provide detailed annual organic growth and margin guidance in keeping with industry best practice and consistent with the above-average visibility its subscription-based business provides.

- Enhance the Board with shareholder input. While we understand, and appreciate, that you are planning to announce the addition of two directors that you recruited after we approached you, Kim Stevenson and Jeff Dailey, we do not believe self-refreshment is enough to build confidence among your shareholders given the Company's long track record of underperformance. In addition to Kim and Jeff, whom we interviewed at your request, we believe you should seek truly outside and independent candidates for the Board who have substantial insurance, information services and turnaround experience and who will have the endorsement and explicit support of shareholders. We note that four of your eleven sitting directors have been on the Board for more than 17 years, more than double the average tenure of directors on the Boards of your self-selected proxy peers.

Divestitures Combined With Operational Improvements Creates Premium Insurance Business, "New Verisk"

We welcome the modest reforms implemented by the Board following our engagement, but the Board has not gone far enough. The Company has underperformed for a decade because of operational missteps, poor capital allocation, a misguided diversification strategy, and lack of sufficient oversight and the Board should fully embrace the value creation plan outlined in this letter to maximize value for all of Verisk's shareholders.

Best Regards,

Edwin Jager Managing Director D. E. Shaw & Co., L.P. |

Michael O'Mary Managing Director D. E. Shaw & Co., L.P. |

Media

Prosek Partners

Brian Schaffer / Kiki O'Keeffe

[email protected] / [email protected]

1 Verisk management estimates from Investor Relations call with representatives of the D. E. Shaw group, May 2021.

2 Insurance segment valuation applies the midpoint of Verisk's historical relative valuation premium to Info Services Peers prior to the Wood Mackenzie deal and the valuation multiple paid by Moody's Corp. for its acquisition of RMS, an insurance data business directly comparable to Verisk's AIR business with lower margins.

3 Moody's Corporation purchased RMS from Daily Mail for more than 30x EBITDA in August 2021

SOURCE The D. E. Shaw Group

Share this article