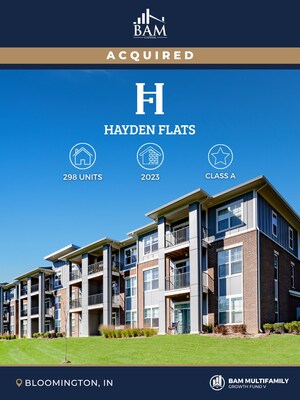

BAM Capital Strengthens BAM Preferred Credit Fund with Addition of Hayden Flats

INDIANAPOLIS, Dec. 9, 2025 /PRNewswire/ -- BAM Capital, a private equity real estate firm specializing in multifamily investments, announces the addition of Hayden Flats to its Preferred Credit Fund (PCF). Hayden Flats also joins the BAM Multifamily Growth Fund V, reinforcing the firm's dual objectives of capital preservation and growth through targeted private credit investments in multifamily real estate.

The BAM Capital Preferred Credit Fund is an open-ended multifamily private credit strategy created for qualified purchasers focused on capital preservation and steady current income. The fund targets total returns of 10–12% and currently pays 8% in monthly distributions, with optional reinvestment. This provides investors a streamlined vehicle for accessing private credit investments, leveraging BAM Capital's expertise and structured, risk-managed approach. All BAM Preferred Credit Fund investments are backed by high-quality multifamily properties providing meaningful stability compared to many other credit fund options.

Hayden Flats is now BAM Preferred Credit Fund's second preferred equity investment alongside Camden Park. The fund's portfolio also features B-note private credit investments in these high-quality 'BAM-owned' multifamily communities: 11Fifty on Olson (Waukee, IA), 32 Union (Noblesville, IN), Aberdeen Apartments (Camby, IN), Hamilton Station Apartments (Pendleton, IN), The Bristol Apartments (Camby, IN), The Ventry (Fort Wayne, IN), Watermark at Jordan Creek (West Des Moines, IA), and WaterStone at Green River (Evansville, IN) in addition to loans on ten other properties owned by others.

The Hayden Flats investment was structured as preferred equity for downside protection and to provide consistent current pay—key priorities with private credit investments.

"The inclusion of Hayden Flats significantly strengthens the BAM Preferred Credit Fund's portfolio diversification and income stability," said a BAM Capital Founder and CEO, Ivan Barratt. "This high-quality asset, structured as a preferred equity investment, adds robust current-pay income and significant down-side protection—demonstrating our commitment to structuring private credit investments that deliver reliable cash flow and superior yields backed by hard assets for our investors."

BAM Capital is a leading private equity firm acquiring and managing institutional-quality apartment communities in growth markets nationwide. BAM Multifamily Growth Fund V continues this strategy by targeting assets with strong value-creation potential through direct equity and private credit investments. The addition of Hayden Flats to both PCF and Fund V highlights the firm's ability to structure private credit investment opportunities aligned with each vehicle's objectives, from income-focused credit to equity growth.

About BAM Capital

BAM Capital is recognized as a leader in private equity real estate, delivering consistent returns and investment opportunities for accredited investors. The firm specializes in acquiring and managing institutional-grade apartment communities in key U.S. growth markets. Through a vertically integrated, data-driven investment platform, BAM Capital aims to deliver attractive, preferred-position returns insulated by an equity cushion, while providing high-quality housing for residents and exceptional value for investors seeking proven alternatives to traditional asset classes.

About BAM Multifamily Growth Fund V

BAM Multifamily Growth Fund V is designed for investors seeking stable multifamily returns and top-tier opportunities among the best investments for accredited investors. As an institutional multifamily investment vehicle, Fund V targets the acquisition and operation of high-quality apartment communities in select U.S. growth markets with strong fundamentals. The fund leverages BAM Capital's disciplined asset selection, operational expertise, and strategic enhancements to create value for investors. By focusing on properties with significant upside and anchored by stable multifamily cash flows, BAM Multifamily Growth Fund V aims to deliver consistent performance for accredited investors seeking attractive alternatives to traditional stocks and bonds.

About Preferred Credit Fund

The Preferred Credit Fund is BAM Capital's open-ended private credit investment strategy dedicated to multifamily real estate. By investing in a mix of senior secured B-notes and preferred equity positions in institutional-quality properties, the fund offers capital preservation and consistent income with well-managed risk for accredited investors.

BAM Capital Reviews

BAM Capital champions transparency and client success. See feedback from investors at BAM Capital Reviews.

Disclosures: All testimonials/reviews are from current clients. No client was compensated for their feedback. There are no material conflicts of interest in providing this feedback.

Investor Education: Pathways to Passive Wealth

To support investor education in private credit investments and multifamily real estate, BAM Capital offers Pathways to Passive Wealth, providing in-depth learning and actionable insights for every experience level.

Disclaimer

This release contains forward-looking statements. These are not guarantees of future performance; results may differ due to risks, uncertainties, and other influencing factors beyond the company's control.

This information is for general purposes and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Investments in BAM Capital funds are offered only by confidential private placement memorandum to qualified investors where permitted by law.

Contact:

Vicki Johnson

317-550-0214

[email protected]

SOURCE BAM Capital

Share this article