NEW YORK, July 19, 2017 /PRNewswire/ -- Betterment, the largest independent online investment advisor, today announced their socially responsible investing (SRI) portfolio strategy. Betterment's SRI strategy aims to maintain the diversified, low-fee approach of Betterment's portfolio advice while increasing exposure to companies that meet SRI criteria.

Socially responsible investing is an approach to investing that reduces exposure to companies that are deemed to have a negative social impact—e.g. companies that profit from poor labor practices or environmental devastation—while increasing investment in companies that have a positive social good—e.g. companies that foster inclusive workplaces or work toward environmental sustainability.

The Betterment investing team, which includes PhDs, CFP® professionals and CFAs, analyzed all low-cost funds oriented toward environmental, social, and governmental (ESG) criteria, searching for products that could replace components of Betterment's portfolio strategy without sacrificing the parts of Betterment's advice that protect investors' returns the most: global diversification, tax optimization, and control of cost.

"At Betterment we're dedicated to offering a personalized experience for all of our customers," said Alex Benke, CFP®, VP of Financial Advice and Investing at Betterment. "This means offering portfolio options that help customers align our advice to their personal values."

Betterment's SRI portfolio approach utilizes the company's portfolio strategy, which achieves global diversification at a low cost, using ETFs. The SRI portfolio reflects a 42% improvement in social responsibility scores[1] on US large cap assets (compared to the Betterment portfolio) while remaining diversified and controlling cost. Betterment achieved the improvement by adding iShares DSI—a broad US ESG stock market ETF—as an alternative for the portfolio's US large cap exposures. An additional ETF, iShares KLD, will serve as the secondary ticker for DSI.

All other SRI portfolio asset classes mirror Betterment's portfolio because an acceptable alternative doesn't yet exist or because the respective fund's fees or liquidity limitations make for a prohibitively high cost.

In the future, Betterment plans to improve their SRI portfolio even further, iterating and adding new SRI funds as they become available. SRI portfolios are also supported in Betterment's features for seeking to increase after-tax returns: Tax-loss harvesting (TLH) and Tax-coordinated portfolios (TCP).

To learn more about the full approach to Betterment's SRI portfolio, the technical whitepaper can be found here. Betterment, which manages more than $9.6 billion in assets for more than 270,000 customers has also expanded its platform to serve advisors and 401(k) markets. For more information, please visit Betterment.com.

Contact Info:

Joe Ziemer, [email protected], 212-228-1328

Arielle Sobel, [email protected], 646-836-9246

Danielle Shechtman, [email protected], 212-228-1328

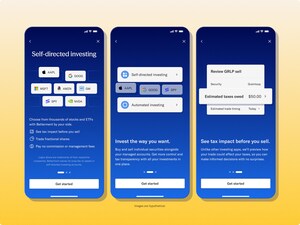

Betterment is the largest independent robo-advisor, helping people to intelligently manage and grow their wealth through smarter technology. With more than 270,000 customers and over $9.6 billion in assets under management, the service offers a globally diversified portfolio of ETFs, designed to help provide you with higher expected returns for retirement planning, building wealth, and other savings goals. Betterment also helps customers get on track for a comfortable retirement with RetireGuide™, a retirement planning tool that lets people know how much they should save and if they are investing correctly. Betterment was a CNBC Disruptor 50, FT 300 and Webby award winner, and it has been featured in the New York Times, Forbes, and the Wall Street Journal. Betterment helps people work to achieve a smarter financial future with minimal effort and for a fraction of the cost of traditional financial services.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Determination of largest independent robo-advisor reflects Betterment LLC's distinction of having highest number of assets under management, based on Betterment's review of assets self-reported in the SEC's Form ADV, across Betterment's survey of independent robo-advisor investing services as of July 11, 2016. As used here, "independent" means that a robo-advisor has no affiliation with the financial products it recommends to its clients. If you also have a 401(k) account through Betterment For Business, that account is subject to a separate fee schedule and is not included in your balance for determining eligibility for the fee tiers or subject to the fee cap mentioned above.

[1] Based on MSCI Inc.'s ESG ratings, the industry standard for assessing social responsibility. See our full whitepaper.

SOURCE Betterment

Share this article